|

Wine

Stocks Housekeeping |

Wine

Stocks Screen Shots |

|

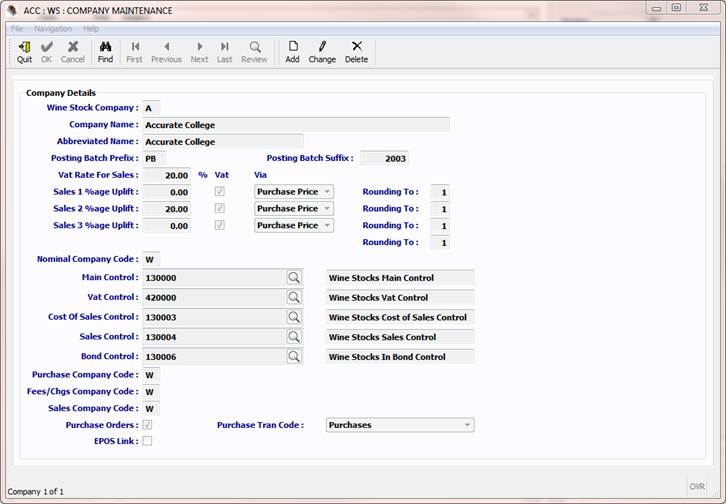

Company Control Maintenance VAT Rate for Sales

– this is the applicable current VAT rate and must be updated if changed by

HMRC Sales Uplifts -

allows the user to define the percentage uplift on either the Purchase Price

or Sales Value 1 to be used as the default percentage uplifts on new wine

stock records. Rounding To –

allows the user to define that sale prices are to be rounded to the nearest

1, 2, 5, 10, 20, 25 or 50 pence. Nominal Company Code –

the Nominal Ledger company linked to this Wine Stock company – the subsequent

control account entries are mandatory and the accounts must exist in the

associated Nominal Ledger. Purchase Company Code – the Purchase Ledger company to be used to obtain

merchant details Fees/Chgs Company Code – the Fees & Charges company to

be used to look up members who are purchasing wine Sales Company Code –

the Sales Ledger company to be used to look up sales invoices which are to

have invoice lines created for the purchase of wine Purchase Orders –

tick if Purchase Order processing is required (see Stock Purchase Orders) EPOS Link –

tick to link the Wine Stock records to the EPOS till system to enable wine to

be sold via any till selected |

|

|

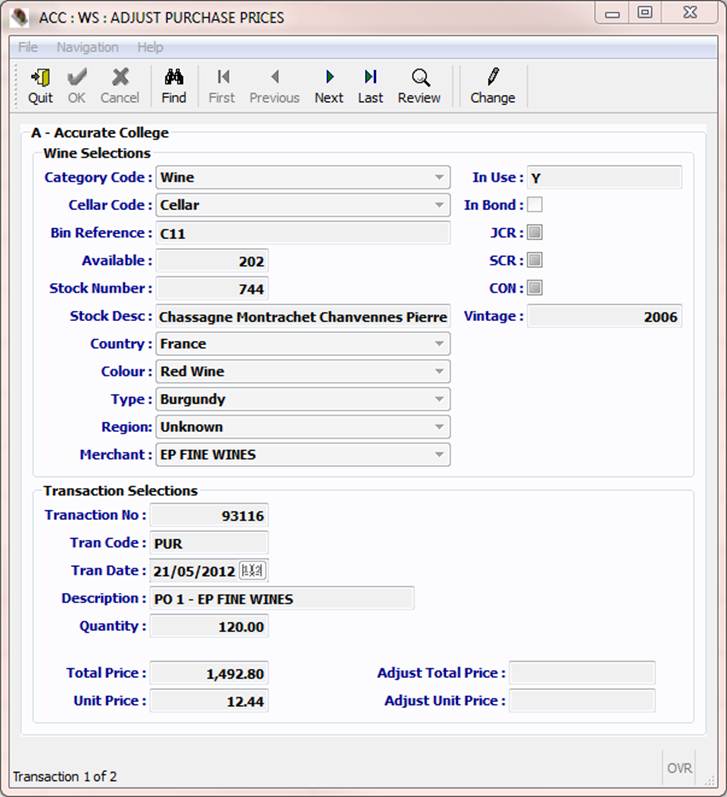

Adjust Stock Purchase Prices This program should only be used by

the System Adminstrator in conjunction with

Accurate Solutions – improper use could corrupt the Wine Stock database Click Find to

enter the selection criteria to search for the appropriate Wine Stock record Click Next/Previous

to display the required wine stock transaction for which the prices

are to be amended Click Change

to adjust either the Total Price or the Unit price of the transaction Click OK to

update or Cancel to discard the entries |

|